Groww Mutual Fund Introduces Groww Nifty EV & New Age Automotive ETF

Groww Mutual Fund’s newest launch features the Groww Nifty EV & New Age Automotive ETF, which is designed to deliver long-term returns through investments in the Nifty EV & New Age Automotive Index. The New Fund Offer (NFO) for this scheme runs from July 22 to August 2, 2024.

This electric vehicle ETF debut aligns with the dynamic growth of India’s EV sector, which saw 1.7 million units sold in FY 2024 and is projected to account for 30% of total automotive sales by 2030.

The underlying index of this fund is the Nifty EV & New Age Automotive Index, which tracks the performance of firms within the electric vehicle ecosystem and those developing new-age vehicles. This index tracks ~33 companies from the Nifty 500 index, each actively involved in various aspects of the EV sector such as electric and hybrid vehicle production, hydrogen fuel technology, battery manufacturing, and charging infrastructure.

Recently India has been paying even more attention to sustainability, and with transport accounting for 13.5% of the country’s total carbon emissions, shifting to electric vehicles is imperative. This move has received significant support, particularly from the government. Reflecting the sector's potential, EV sales in India almost doubled in 2023, making up 2% of all passenger vehicle sales.

Companies tracked by Nifty EV & New Age Automotive Index:

● EV Manufacturers

● Hybrid vehicle manufacturers

● Hydrogen fuel-based vehicle manufacturers

● Green hybrid vehicle manufacturers

● Electric battery manufacturers

● EV components producers

● Raw materials suppliers for EVs

● Raw materials suppliers for autonomous vehicles

● Autonomous vehicle producers

● Autonomous vehicle technology suppliers

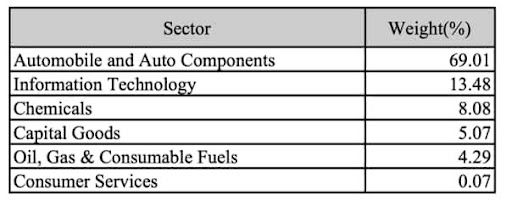

Sector-wise Index Composition

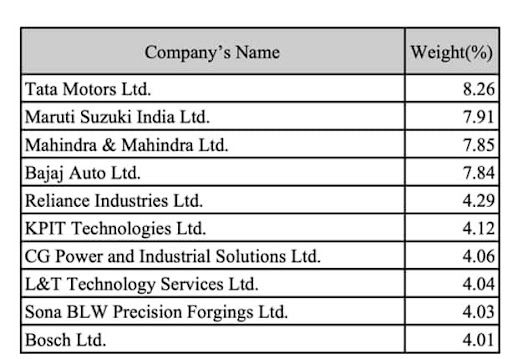

Top constituents by weightage

More About Groww Nifty EV & New Age Automotive ETF

The Groww EV ETF is for investors who are looking to achieve long-term capital growth by investing in equity and related instruments from the Nifty EV & New Age Automotive Index. However, it is advisable for investors to seek guidance from their financial advisors prior to making any investment decisions.

Allocation of the scheme

|

Instruments |

Indicative Allocation (% of total assets) |

|

Securities included in the Nifty EV and New Age Automotive Index |

Minimum - 95 Maximum - 100 |

|

Money market instruments/debt securities, Instruments and/or units of debt/liquid schemes of domestic Mutual Funds |

Minimum - 0 Maximum - 5 |

The fund, overseen by Abhishek Jain, requires a minimum investment of INR 500, with additional investments accepted in multiples of INR 1.

Before investing, it is essential for investors to review the Scheme Information Document/Key Information Memorandum available at https://www.growwmf.in/downloads/sid.

The Groww Nifty EV & New Age Automotive ETF NFO can be subscribed to until August 2, 2024, via Groww Mutual Fund directly or through other mutual fund investment platforms. This scheme aspires to become a leading choice for those interested in the electric vehicle sector.