Groww Mutual Fund Introduces Groww Nifty EV & New Age Automotive ETF FOF

For investors seeking top EV mutual fund options, Groww Mutual Fund has recently launched the Groww Nifty EV & New Age Automotive ETF FOF. This new scheme is engineered to aim to achieve long-term capital growth by investing in units of the Groww Nifty EV & New Age Automotive ETF, making it an option for those interested in electric vehicle mutual funds. The NFO period for this scheme runs from July 24 to August 7, 2024.

This scheme is designed to capitalize on India’s rapidly expanding Electric Vehicle (EV) market, which saw sales of 1.7 million units in FY 2024 and is projected to account for 30% of total annual auto sales by 2030. The benchmark for this ETF FOF is the Nifty EV & New Age Automotive Index, which tracks approximately 33 companies from the Nifty 500 index. These firms are engaged in various aspects of the EV sector, including the production of electric, hybrid, and hydrogen-fueled vehicles, battery manufacturing, charging infrastructure, and other key components of the EV ecosystem.

With a focus on a more sustainable future and addressing the fact that transportation contributes 13.5% to the nation's total carbon emissions, India is intensifying its efforts for electric vehicle adoption. The government's robust support has accelerated advancements in this sector. Demonstrating its growth prospects, EV sales in India nearly doubled in 2023, representing 2% of all passenger vehicle sales.

Companies tracked by Nifty EV & New Age Automotive Index:

● EV Manufacturers

● Hybrid vehicle manufacturers

● Hydrogen fuel-based vehicle manufacturers

● Green hybrid vehicle manufacturers

● Electric battery manufacturers

● EV components producers

● Raw materials suppliers for EVs

● Raw materials suppliers for autonomous vehicles

● Autonomous vehicle producers

● Autonomous vehicle technology suppliers

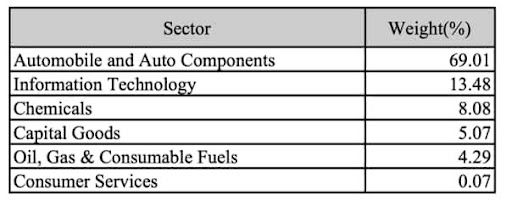

Sector-wise Index Composition

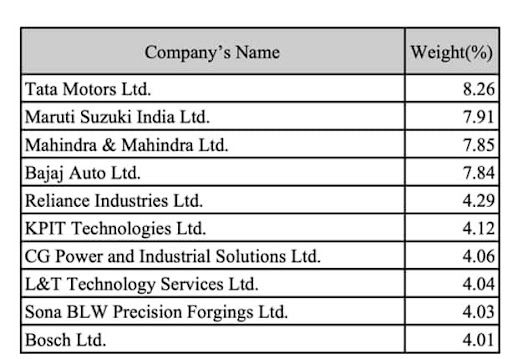

Top constituents by weightage

About Groww Nifty EV & New Age Automotive ETF FOF

This scheme is for investors aiming for long-term capital growth, primarily by investing in units of the Groww Nifty EV & New Age Automotive ETF. It is distinguished as one of the top-performing EV mutual funds due to its broad exposure to the electric vehicle sector. However, it's important to note that the scheme carries a very high level of risk.

Allocation of the scheme

|

Instruments |

Indicative Allocation (% of total assets) |

|

Securities included in the Nifty EV and New Age Automotive Index |

Minimum - 95 Maximum - 100 |

|

Money market instruments/debt securities, Instruments and/or units of debt/liquid schemes of domestic Mutual Funds |

Minimum - 0 Maximum - 5 |

Managed by Abhishek Jain, this scheme requires a minimum investment of INR 100, with additional amounts accepted in multiples of INR 1 for purchases and switches through monthly SIPs. For lump-sum investments, the minimum amount is INR 500, with subsequent investments and switches also in multiples of INR 1. An exit load of 1% applies if the investment is redeemed within 30 days from the allotment date.

Investors are advised to review the Scheme Information Document/Key Information Memorandum prior to making any investment (available at https://www.growwmf.in/downloads/sid).

The Groww EV mutual fund NFO is open for investments until August 7, 2024, and can be accessed directly through Groww Mutual Fund or via other mutual fund investment platforms.

https://groww.in/nfo/groww-nifty-ev-new-age-automotive-etf-fof-direct-growth