Union Budget Highlights for Mutual Fund Investors

The Finance Minister presented the Union Budget 2024 in Parliament this week, outlining a vision focused on nine key priorities, which are aimed at creating opportunities for all in pursuit of 'Viksit Bharat'.

How will direct tax proposals affect salaried employees and investors?

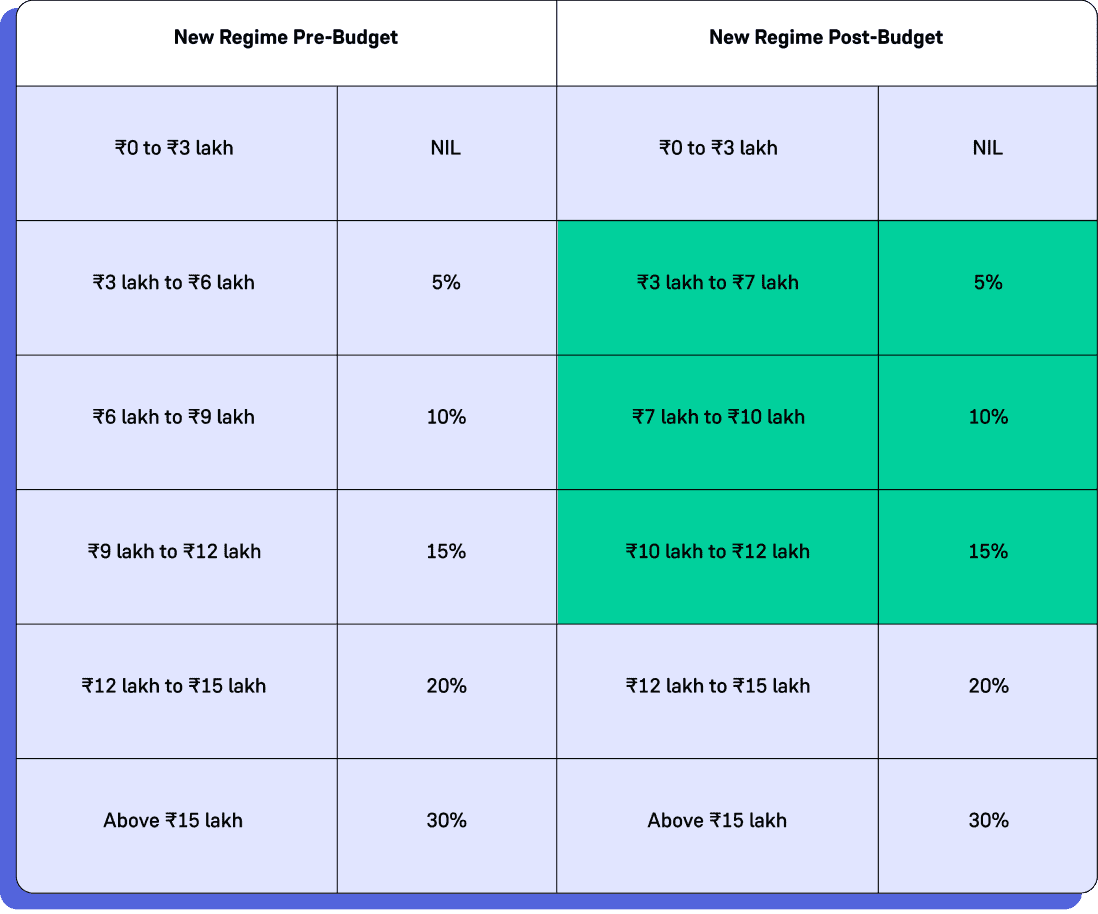

Income Tax: This budget aims to make the New Tax Regime more attractive by introducing the following revisions, which are aimed to benefit a large number of taxpayers.

The standard deduction for salaried employees has also been increased from ₹50,000 to ₹75,000. Similarly, the deduction on family pension for pensioners has been increased from ₹15,000 to ₹25,000.

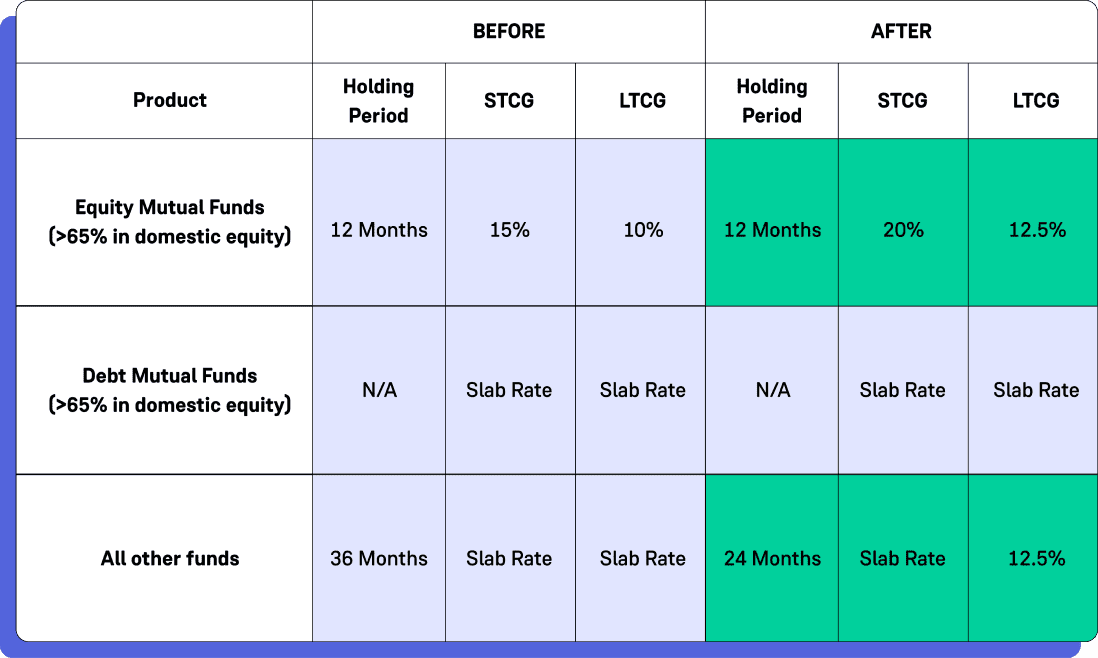

Capital Gains Tax: Taxation of capital gains has also been simplified.

Buy-Back of Shares: Tax on the income received by shareholders from share buy-backs will be treated as dividend income starting from October 1, 2024, rather than the current additional income tax imposed on the company. Additionally, the cost of these shares will be considered a capital loss for the investor.

Securities Transaction Tax (STT): With effect from October 1, 2024, the STT rates on the sale of Futures and Options (F&O) have been increased.

What changes in capital gains tax mean for mutual funds investors?

- The long-term capital gains (LTCG) tax rate has been revised to 12.5%, while the short-term capital gains (STCG) tax rate has been revised to 20%.

- The exemption limit for LTCG on listed equity and equity-oriented mutual funds has increased to ₹1.25 lakh from ₹1 lakh.

- The budget has effectively scrapped the 36-month holding period. To classify assets as long-term or short-term, there will now be two holding periods: 12 months and 24 months.

- Unlisted bonds, debentures, debt mutual funds, and market-linked debentures will be taxed on capital gains at applicable rates, regardless of the holding period.