Unlocking the Potential of ETFs tracking/replicating Nifty 1D Rate Index

Imagine you have cash that's sitting idle, waiting for the right potential opportunity to be put to use. You don't want to lock it away for too long, nor do you want to take on too much risk. Or perhaps you're a trader with cash sitting in your trading account that isn't currently deployed in the market. What if there were a way to aim to keep that money working for you, even while it's waiting on the sidelines?

That's where ETFs based on the Nifty 1D Rate Index could come into picture

These ETFs offer a way to potentially earn returns on idle cash, whether you're looking to park your funds with quick access when needed temporarily.

ETFs based on the Nifty 1D Rate Index invest in the underlying securities of the Nifty 1D Rate Index, which include instruments with a 1-day maturity, such as Tri-Party REPOs, Repos in Government Securities, Reverse Repos, and other overnight instruments. These instruments are essentially cash equivalents - potentially ready to be converted back to cash when needed.

Some of the Key Benefits of ETFs Based on Nifty 1D Rate Index

Potentially Higher Liquidity with Comparatively Lower Risk

The ETF focuses on investments in overnight securities, which aims to offer a comparatively lower risk profile while potentially providing high liquidity. investors might be able to redeem their ETF units back to cash, allowing funds to remain accessible for other probable investable opportunities or financial needs.

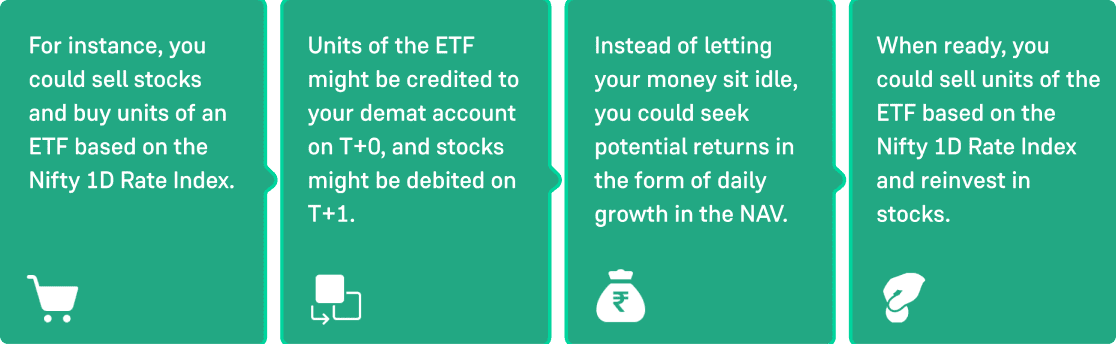

Cash Equitisation

These ETFs allow investors to potentially earn returns on idle cash by investing in overnight securities that aim to generate daily income. However, investors should be aware that investments in ETFs carry a high risk.

Aims for Tax Efficiency

An ETF based on the Nifty 1D Rate index does not distribute dividends, which may make it more tax-efficient, as taxes are only applicable upon the sale of units, potentially offering after-tax returns. Additionally, investors benefit from the absence of Securities Transaction Tax (STT) on transactions involving these ETFs, making them comparatively more investable for frequent traders.

Potential Benefits Over Traditional Instruments

The ETF may offer potential returns compared to traditional instruments, making it an investable option for investors seeking returns on idle cash.

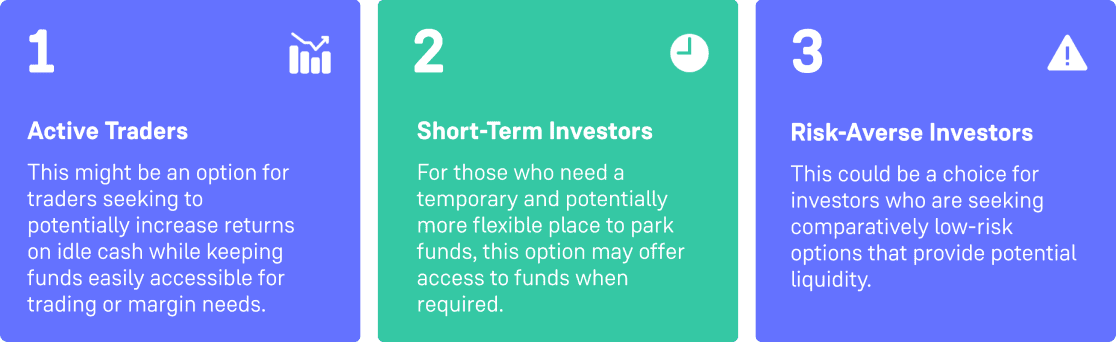

Who May Consider ETFs Based on Nifty 1D Rate Index?

These ETFs could be considered by those who are:

What do you think about ETFs that track the Nifty 1D Rate Index?